FirstPoint, has its roots in the formation of the Greensboro Merchants Association (now Guilford Merchants Association). GMA was established in February, 1906, succeeding a rather loose organization or group known as the Retailer Dealers Protective Union, which had been in existence as far back as 1886. The old organization published the "Books of Ratings" which listed individuals by name and gave a code letter designating how the debtors met their obligations. These books were supplemented by monthly addendums which were then incorporated into the yearly book. Consequently, the "Credit Bureau of Greensboro" has been in existence almost one hundred years. In February, 1906, however, a stricter local organization was set up and, in quoting from its constitution and bylaws, it said: the Association was to "establish and conduct a Central Bureau of Credits for the collection from and dissemination among its members of information concerning the responsibility and reliability of persons seeking credit and, to this end, to establish and maintain, for the members and the use of its members, a rating system and report to its members from time to time, and as they shall require the same, list the delinquent debtors against whom claims have been placed for collection with the corporation."

FirstPoint, has its roots in the formation of the Greensboro Merchants Association (now Guilford Merchants Association). GMA was established in February, 1906, succeeding a rather loose organization or group known as the Retailer Dealers Protective Union, which had been in existence as far back as 1886. The old organization published the "Books of Ratings" which listed individuals by name and gave a code letter designating how the debtors met their obligations. These books were supplemented by monthly addendums which were then incorporated into the yearly book. Consequently, the "Credit Bureau of Greensboro" has been in existence almost one hundred years. In February, 1906, however, a stricter local organization was set up and, in quoting from its constitution and bylaws, it said: the Association was to "establish and conduct a Central Bureau of Credits for the collection from and dissemination among its members of information concerning the responsibility and reliability of persons seeking credit and, to this end, to establish and maintain, for the members and the use of its members, a rating system and report to its members from time to time, and as they shall require the same, list the delinquent debtors against whom claims have been placed for collection with the corporation."

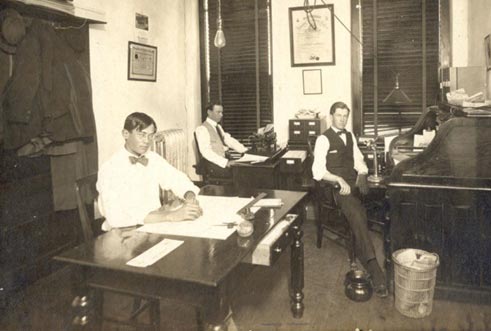

In an interview with the first president of the Association in 1941, Mr. J. M. Hendrix was asked, "What in your opinion was the greatest contribution of the newly formed Association in the commercial life of the city?" Mr. Hendrix stated that, in his opinion, the organization was instrumental in building a spirit of fellowship and friendship among the business people of the city which was nonexistent before its formation. "Back in the gay nineties, each merchant regarded every other merchant as a rascal and a scoundrel. The word 'ethics' was still in the dictionary, but its meaning had never been looked up. If you would misrepresent the goods of your competitor and create public distrust, it was considered fine business. Many merchants up and down the street of the struggling village known as Greensboro were not on speaking terms. If a customer owed a merchant and wouldn't pay, it was quite all right to recommend the customer as a good risk to some other merchant. In fact, it got so that when a customer was said to be a good risk, it was a question of whether to trust the merchant doing the recommending instead of the customer for the credit." Mr. Hendrix's final remarks were, "Unless you lived back in the days when a merchant was regarded by competitors and the public alike with distrust and suspicion, you cannot comprehend the high standards of business ethics of merchandising which we enjoy today."

In 1948, the structure of the organization changed. The members of the Greater Greensboro Merchants Association created a new affiliated organization, the Credit Bureau of Greater Greensboro, Inc. to operate the Credit Bureau Reporting and Collection Divisions. The creation of this new structure was necessitated in order for the Merchants Association to continue as a nonprofit organization.

Due to corporate growth and acquisitions, FirstPoint, was formed in 2001 as a holding company designed to maximize operating synergies and technology among the Credit Bureau and its for-profit subsidiaries. The new FirstPoint identity provided a unifying umbrella for the various business units- allowing joint marketing and growth opportunities. Today, the FirstPoint family of resources offers businesses a variety of information and operation services that include revenue cycle management, background screening services, residential tenant screening and mortgage solutions, as well as professional management of trade associations, professional societies and licensure boards. The company is continuing its successful growth strategy of vertical business development and acquisition.